Getting ready for NZ IFRS 15 Revenue from Contracts with Customers

With the adoption of NZ IFRS 15 Revenue from Contracts with Customers (NZ IFRS 15) becoming mandatory for periods beginning 1 January 2018, all Tier 1 and Tier 2 for-profit entities should have begun, or should soon be starting, their projects to transition to and implement the new revenue standard.

NZ IFRS 15 is expected to have a significant impact on entities in a number of industries from a recognition, timing and measurement of revenue perspective. In addition, all Tier 1 and Tier 2 entities will be impacted by the presentation and disclosure requirements introduced by NZ IFRS 15 and these may present a significant challenge both on transition and going forward.

As a reminder to Financial Market Conduct Act reporting entities, the Financial Markets Authority have indicated that they will be focussing on the disclosures provided of known or reasonably estimable information about the possible impact of NZ IFRS 15 on entities’ financial statements in the current reporting season.

In summary, NZ IFRS 15 establishes a single and comprehensive framework which sets out how much revenue is to be recognised, and when. The core principle is that a vendor should recognise revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the vendor expects to be entitled in exchange for those goods or services.

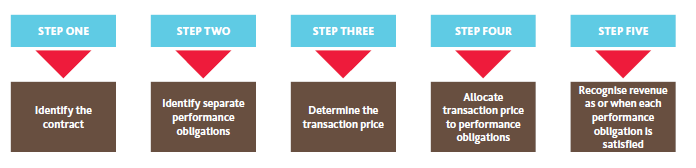

Revenue will now be recognised by a vendor when control over the goods or services is transferred to the customer. The application of the core principle in NZ IFRS 15 is carried out in five steps:

For those entities that have not yet started the transition process and may require some additional guidance, we have a number of resources available to help you with this task:

For more on the above, please contact your local BDO representative.