Financial Instruments – are you ready for transition to the new standard?

NZ IFRS 9 Financial Instruments (NZ IFRS 9) is effective for Tier 1 and Tier 2 for-profit entities for annual periods beginning on or after 1 January 2018, with retrospective appliction. The new standard replaces NZ IAS 39 Financial Instruments: Recognition and Measurement (NZ IAS 39) and introduces major changes to classification and measurement, impairment and hedge accounting.

It is thus key that affected entities assess the impacts of the new standards now so that processes can be put in place to track information for comparative purposes.

One of the first items on an entity’s to do list should be an analysis of what financial instruments it holds and what categories these are currently accounted under, as there are likely to be classification and measurement implications on transition to the new standard.

NZ IFRS 9 replaces the rules based model in NZ IAS 39 with an approach which bases classification and measurement on the business model of an entity, and on the cash flows associated with each financial asset. This has resulted in:

- Elimination of the ‘held to maturity’ category

- Elimination of the ‘available-for-sale’ category

- Elimination of the requirement to separately account for (i.e. bifurcate) embedded derivatives in financial assets. However, the concept of embedded derivatives has been retained for financial liabilities and for non-financial assets.

- The changes in the fair value of financial liabilities measured at fair value through profit or loss, attributable to changes in the entity’s own credit status, are presented in other comprehensive income rather than profit or loss

- Elimination of the limited exemption to measure unquoted equity investments at cost rather than at fair value, in the rare circumstances in which the range of reasonable fair value measurements is significant and the probabilities of the various estimates cannot reasonably be assessed. This is expected to have a significant impact on entities that have investments in unlisted entities that are not subsidiaries, associates or joint ventures, that are currently measured at cost.

The impacts of the new standard will be particularly felt around the classification of financial assets. Under NZ IFRS 9, a financial asset will only be able to be classified as subsequently measured at amortised cost if it meets both of the following criteria:

- “Hold-to-collect” business model test – The asset is held within a business model whose objective is to hold the financial asset in order to collect contractual cash flows; and

- “SPPI” contractual cash flow characteristics test – The contractual terms of the financial asset give rise to cash flows that are solely payments of principal and interest (SPPI) on the principal amount outstanding on a specified date.

Examples of financial instruments that are likely to be classified and accounted for at amortised cost under NZ IFRS 9 include:

- Trade receivables

- Loan receivables with ‘basic’ features

- Investments in government bonds that are not held for trading

- Investments in term deposits at standard interest rates.

All other financial assets that do not meet the above requirements will need to be carried at fair value. The “default” category of fair value measurement is measurement at fair value through profit or loss. Fair value gains on certain assets may be able to be recorded in other comprehensive income if certain criteria are met. We will discuss these in upcoming editions of Accounting Alert.

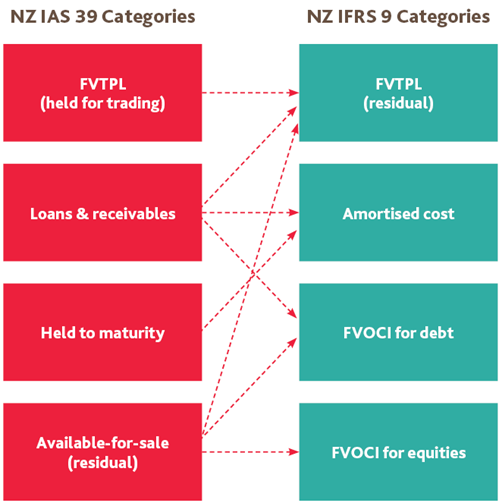

The following diagram sets out the likely potential reclassifications of financial assets from the NZ IAS 39 categories to the IFRS 9 categories for financial assets.

Next month we will discuss the “hold-to-collect” business model and “SPPI” contractual cash flow characteristics test for financial assets held at amortised cost in more detail.

For more on the above, please contact your local BDO representative and also refer to our BDO International Publication IFRS in Practice 2016 – IFRS 9 Financial Instruments.