Meaningful reporting – 30 June 2022

While the immediate effects of COVID-19 may have subsided, entities continue to face changes in circumstances and uncertainties about future economic and market conditions, which may impact business strategies and future financial performance.

These uncertainties should be factored into the assumptions used for financial reporting purposes, and should be reasonable and supportable to ensure that financial statements provide useful and meaningful information for investors and other users.

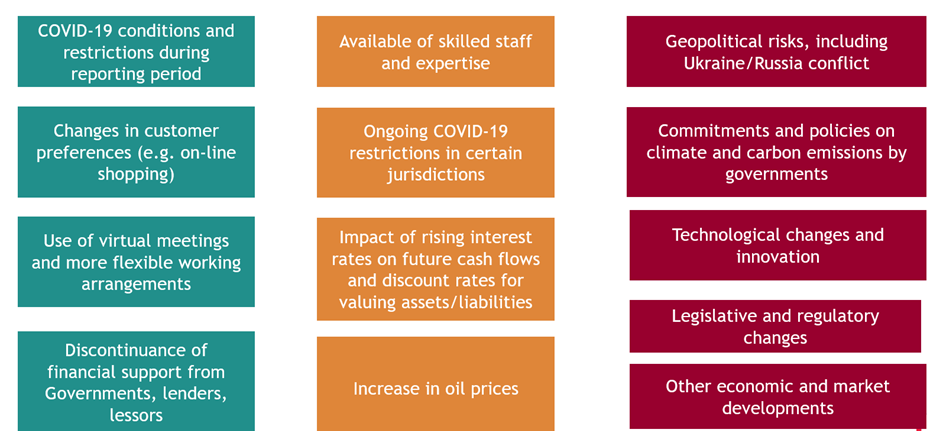

Examples of changes in circumstances, uncertainties, and risks to be considered when preparing 30 June 2022 financial reports include those listed in the diagram below. This list is not exhaustive.

The following sets out certain areas of the financial statements that directors and preparers should focus on for 30 June 2022 reporting

Asset values

|

Financial statement area

|

Areas requiring focus

|

|

Impairment of non-financial assets

|

- Must conduct an annual impairment test for goodwill, indefinite-life intangible assets, and intangible assets not yet available for use.

- Ensure impairment tests are conducted for other non-financial assets if there are new or continuing indicators of impairment.

- Ensure key assumptions used to determine recoverable amounts are appropriate.

- Estimation uncertainties must be disclosed, together with sensitivity analyses on probability-weighted scenarios.

|

|

Values of property assets

|

- Factors that could adversely affect values of commercial and residential properties should be considered, including:

- Changes in the office space needs of tenants due to more flexible work arrangements

- Online shopping trends

- Future economic and industry impacts on tenants

- Financial condition of tenants

- Restructured lease agreements.

- Complex lease accounting requirements, treatment of rent concessions by lessors and lessees, and impairment of lessees’ right-of-use assets.

|

|

Expected credit losses (ECL) on loans and receivables

|

- Appropriateness of key assumptions used to determine ECL, which should be reasonable and supportable.

- The need for more up-to-date information about borrowers’ and debtors’ circumstances.

- Short-term liquidity issues for some borrowers and debtors, as well as their financial condition and earnings capacity.

- Past models and experience may not be representative of current expectations and probability-weighted scenarios may be needed.

- Disclosure of estimation uncertainty and key assumptions.

|

|

Value of other assets

|

- Value of inventories, including whether all estimated costs of completion costs necessary to make the sale have been taken into account when determining net realisable value.

- Whether probable that deferred tax assets will be realised.

- The value of investments in unlisted entities.

|

Provisions

The adequacy of provisions for:

- onerous contracts,

- financial guarantees given,

- restructuring provisions,

- leased property make- good provisions, and

- mine site restoration provisions

should all be considered, taking current economic conditions into account.

Solvency and going concern assessments

Entities should consider factors affecting the business which could impact the entity’s solvency and going concern assessment. These were highlighted in the diagram above.

Subsequent events

Entities should review events occurring after the end of the reporting period, in order to determine whether these are ‘adjusting’ or ‘non-adjusting’ post-balance date events.

Disclosures in the financial statements and directors’ and/or chairperson’s reports

Lastly, entities should focus on ensuring adequate disclosures as outlined in the table below.

|

Consider

|

Focus areas

|

|

General considerations

|

- Put yourselves in the shoes of investors and consider what information investors would want to know.

- Disclosures should be specific to the entity (i.e. not boilerplate).

- Consider changes from the previous period and disclose accordingly.

|

|

Disclosures in financial statements

|

- Disclose uncertainties and sensitivity analyses for key assumptions.

- Explain where uncertainties have changed since the previous full-year or half-year financial report.

- Consider appropriate current versus non-current classification of assets and liabilities in the balance sheet, having regard to maturity dates, payment terms, and compliance with debt covenants.

|

|

Disclosures in directors’ and/or chairperson’s reports

|

- The directors’ and/or chairperson’s reports should complement the financial statements and ‘tell the story’ of how the business has been impacted by the COVID-19 pandemic and changing circumstances.

- Explain underlying drivers of results and financial position, as well as the risks, management strategies, and future prospects.

- The most significant business risks at the whole-of-entity level.

- Climate change risk could have a material impact on future prospects. Directors should consider disclosing information under recommendations of the External Reporting Board and Task Force on Climate-Related Financial Disclosures.

|

|

Assistance and support by government and others (e.g. lenders and landlords)

|

- Prominently disclose in the financial report and directors’ and/or chairperson’s reports:

- Material amounts

- Duration of support

- Impact of its discontinuance.

- For example: Covid-19 wage subsidy, loan deferrals and restructuring, and rent deferrals and waivers.

|

|

Non-IFRS financial information

|

- Should not be presented in a misleading manner.

- If asset impairment losses were excluded from a non-IFRS profit measure in a previous year, then reversals of impairment should also be excluded from the non-IFRS profit measure in subsequent years.

|

|

Disclosure in half-year financial statements

|

- May need to include disclosure about significant developments and changes in circumstances since the 31 December 2021 financial statements.

|

Need assistance?

Please contact our IFRS Advisory team if you need support with any financial reporting matters for your 30 June 2022 financial reports.

For more on the above, please contact your local BDO representative.

This publication has been carefully prepared, but is general commentary only. This publication is not legal or financial advice and should not be relied upon as such. The information in this publication is subject to change at any time and therefore we give no assurance or warranty that the information is current when read. The publication cannot be relied upon to cover any specific situation and you should not act, or refrain from acting, upon the information contained therein without obtaining specific professional advice. Please contact the BDO member firms in New Zealand to discuss these matters in the context of your particular circumstances.

BDO New Zealand and each BDO member firm in New Zealand, their partners and/or directors, employees and agents do not give any warranty as to the accuracy, reliability or completeness of information contained in this article nor do they accept or assume any liability or duty of care for any loss arising from any action taken or not taken by anyone in reliance on the information in this publication or for any decision based on it, except in so far as any liability under statute cannot be excluded. Read full Disclaimer.