What's new for Tier 1 and Tier 2 For-Profit entities for 30 June 2017 reporting season?

The good news

The good news is that while there are several amendments (see "What are the changes?" below) applying for the first time to Tier 1 and Tier 2 For-Profit June 2017 annual financial statements, most entities will only be impacted by the ‘decluttering’ changes as a result of the disclosure initiative.

Changes impacting agricultural entities

Agricultural entities may also be impacted by changes to the accounting for bearer plants which are effective for the first time at 30 June 2017.

Other changes

Otherwise, changes included in new standard NZ IFRS 14 Regulatory Deferral Accounts and the other amending standards are transaction/balance specific, and therefore unlikely to impact your accounts except in specific circumstances.

Half-years

For listed entities reporting half-year results at 30 June 2017, there are no major new standards that will impact your interim financial report for the first time, but you may be impacted by the recent IFRS Interpretations Committee agenda decision on deferred tax liabilities for indefinite-lived intangibles; and the amendments to NZ IAS 12 Income Taxes dealing with recognition of deferred tax assets for unrealised losses.

In addition it is recommended that entities begin assessing the disclosure requirements introduced by the amendments to NZ IAS 7 Statement of Cash Flows as a result of the disclosure initiative for 31 December 2017 financial statements.

The calm before the storm

This is the calm before the storm, with NZ IFRS 9 Financial Instruments and NZ IFRS 15 Revenue from Contracts with Customers effective for the first time for your 30 June 2019 annual periods, and NZ IFRS 16 Leases effective for the first time for 30 June 2020 annual periods. For insurance companies, IFRS 17 Insurance Contracts will impact you for the first time for 30 June 2022 financial years.

As mentioned in our April 2017 edition of Accounting Alert the Financial Markets Authority reminds companies that it expects them to be able to quantify the impacts of NZ IFRSs 9 and 15 in their June 2017 annual financial statements where adjustments for application of the new standards will be made on a fully retrospective basis.

What are the changes?

You need to consider the following accounting standards and amending standards when preparing your 30 June 2017 annual financial statements:

- Decluttering ( Disclosure Initiative: Amendments to NZ IAS 1)

- Bearer plants (Agriculture: Bearer Plants – Amendments to NZ IAS 16 and NZ IAS 41)

- Accounting for the acquisition of joint operations (Accounting for Acquisitions in Joint Operations: Amendments to NZ IFRS 11)

- Clarification of acceptable methods of depreciation or amortisation (Clarification of Acceptable Methods of Depreciation and Amortisation: Amendments to NZ IAS 16 and NZ IAS 38)

- Equity method in separate financial statements (Equity Method in Separate Financial Statements: Amendments to NZ IAS 27)

- Investment entities: applying the consolidation exemption (Investment Entities: Applying the Consolidation Exemption: Amendments to NZ IFRS 10, NZ IFRS 12 and NZ IAS 28)

- Annual improvements (Annual Improvements to New Zealand Accounting Standards 2012-2014 Cycle)

- NZ IFRS 14 Regulatory Deferral Accounts

- Calculation of deferred tax on an indefinite life intangible asset (IFRS Interpretations Committee agenda decision)

While many of the above accounting standards and amending standards applied for the first time to entities with years ending 31 December 2016, this is the first time these standards will apply to entities with an annual reporting period ending 30 June 2017.

These accounting standards and amending standards are discussed in more detail below.

Decluttering

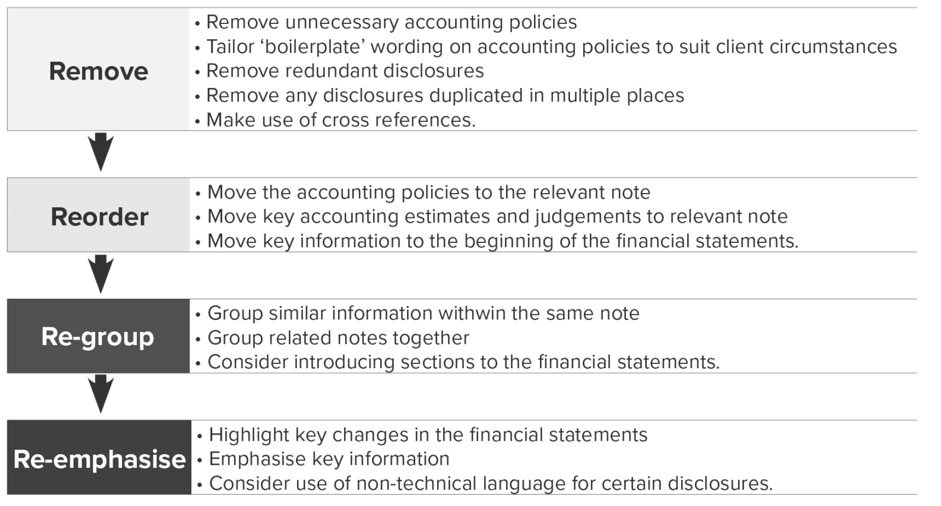

As part of the International Accounting Standards Board’s initiative to improve disclosures in financial statements (Disclosure Initiative), amendments have been made to NZ IAS 1 Presentation of Financial Statements to facilitate ‘decluttering’ of financial statements by allowing preparers to apply judgement when deciding which mandatory disclosures are relevant to users, and which are not.

Besides full general purpose financial statements, this ‘decluttering process’ should also be applied to financial statements prepared under the reduced disclosure regime.

For a reminder on how to implement these changes and our ‘4R’ process, please refer to our December 2016 edition of Accounting Alert

Bearer Plants

A bearer plant is a living plant that is used in the production process of agricultural produce, is expected to bear produce for more than one period, and has a remote likelihood of being sold (NZ IAS 41, paragraph 5). Entities growing produce for sale on plants such as grape vines, fruit trees, oil palms or tea bushes will be affected by these amendments.

The amendment significantly changes the way entities account for bearer plants. The entire plant is no longer accounted for at fair value with gains and losses reported in profit or loss, but separated into the bearer plant, and the produce on the bearer plant.

The produce on the bearer plant remains within the scope of NZ IAS 41, and continues to be accounted for at fair value. The bearer plant itself now falls within the scope of NZ IAS 16 Property, Plant and Equipment, and is initially measured at cost, and then subsequently accounted for under either the cost or revaluation model.

Action points

You will need to account for these changes retrospectively in accordance with NZ IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors, however the amendment includes certain transitional relief, such as being able to revert to the cost model, or using fair values at transition date as deemed cost.

Accounting for the acquisition of joint operations

As a result of diversity in practice, NZ IFRS 11 Joint Arrangements was amended to include guidance on the accounting for an acquisition of a joint operation that constitutes a business.

If an entity acquires an interest in a joint operation that is a business, it will follow the acquisition approach in NZ IFRS 3 Business Combinations, provided the principles do not conflict with any guidance in NZ IFRS 11. This means that the entity will recognise:

- Assets and liabilities as its share of the fair values, including its share of the related deferred tax assets and liabilities

- Acquisition-related costs as expenses in profit or loss, and

- Goodwill as the excess of the consideration over the fair value of the identifiable net assets acquired.

Action points

Entities only need to apply this amendment prospectively. If you acquire a joint operation that constitutes a business from 1 July 2016, you will need to account for this transaction using the acquisition method prescribed in NZ IFRS 11.

Clarification of acceptable methods of depreciation or amortisation

The amendment to NZ IAS 16 Property, Plant and Equipment clarifies that a revenue-based depreciation model is never permitted for items of property, plant and equipment because revenue generated by the asset does not adequately capture the consumption of the economic benefits embodied within the asset. For example, it may be appropriate to depreciate a production machine based on the number of widgets it produces, but it would not be considered appropriate to depreciate the production machine based on revenue from the widgets because the entity can sell the widgets for a range of different prices.

A similar amendment made to NZ IAS 38 Intangible Assets clarifies that a revenue-based amortisation model is only permitted in very limited circumstances, including:

- Where an intangible asset is a measure of revenue — for example a toll road operator may have the right to operate a toll road up until the point that a certain amount of revenue has been generated, or

- Where revenue and consumption of the economic benefits are highly correlated — for example where an entity holds a concession to explore and extract gold from a gold mine that expires when total cumulative revenue reaches a certain threshold.

Action points

If your current accounting policy is to depreciate property, plant and equipment or amortise intangible assets based on revenue, you need to assess whether to change this policy from 1 July 2016 to another acceptable method (e.g. straight line, or units of production) that is permitted under NZ IAS 16 or NZ IAS 38.

Changes to depreciation methods will be accounted for prospectively as changes in an accounting estimate.

Equity method in separate financial statements

The amendments to NZ IAS 27 Separate Financial Statements allow entities to measure their investments in subsidiaries, associates or joint ventures using the equity method (as described in NZ IAS 28 Investments in Associates and Joint Ventures) in their separate financial statements.

NZ IAS 27 previously only allowed entities to measure investments in subsidiaries, associates or joint ventures at either cost or fair value, in accordance with NZ IAS 39 Financial Instruments: Recognition and Measurement (or NZ IFRS 9 Financial Instruments, if early adopted).

These amendments apply retrospectively.

Action points

When first adopting these amendments, you may choose to continue with your accounting policy to hold your investments at cost or fair value, or you may choose to adopt the new equity accounting option, which will result in an increase in investments, retained earnings and other reserves on transition date.

Investment entities: applying the consolidation exemption

These changes clarify a number of different aspects of accounting for investment entities, as follows:

Intermediate parent entity consolidation exemption

Previously, intermediate entities were relieved from preparing consolidated financial statements where the ultimate parent prepared consolidated financial statements that complied with NZ IFRS, which were available for public use.

The first amendment extends these exemptions where the ultimate parent entity is an investment entity, and therefore does not prepare consolidated financial statements, instead measuring investments in subsidiaries at fair value.

Subsidiaries that provide investment-related services

The second amendment clarifies that an investment entity must consolidate subsidiaries, rather than measure them at fair value through profit or loss, if they provide investment-related services. Such a subsidiary will only be consolidated if:

- It is not itself an investment entity, and

- Its main purpose is to provide investment-related services.

Equity accounting investment entities

If you are equity accounting an associate or joint venture that is an investment entity, you may choose to retain the fair value measurement applied by the associate or joint venture to its investments in subsidiaries. This means that no adjustments need to be made to unwind fair value measurement.

Action points

Consider if you are able to take advantage of the relief provided by these amendments.

Annual improvements

The 2012-2014 annual improvements are not expected to have a major impact on current practice. These are summarised in the table below:

|

Standard

|

Impact of Amendments

|

|

NZ IFRS 5 Non-current Assets Held for Sale and Discontinued Operations

|

If you reclassify an asset/disposal group from being held for sale to being held for distribution to owners, or from being held for distribution to owners to being held for sale, this is considered to be the continuation of the original plan of disposal.

If an asset ceases to be held for distribution to owners, the usual NZ IFRS 5 requirements for assets that cease to be classified as held for sale apply.

|

|

NZ IFRS 7 Financial Instruments: Disclosures

|

When disclosing details of transferred financial assets under NZ IFRS 7.42D to 42G, there will be ‘continuing involvement’ for a service contract where the servicing fee is dependent on the amount or timing of cash flows collected from the transferred asset.

Offsetting disclosures required by NZ IFRS 7.13A to 13F are not explicitly required in interim periods but may be required if significant under NZ IAS 34 Interim Financial Reporting.

|

|

NZ IAS 19 Employee Benefits

|

High quality corporate bonds or national government bonds used to determine the discount rate must be denominated in the same currency as the benefits that will be paid to the employee.

|

|

NZ IAS 34 Interim Financial Reporting

|

If the disclosures required by NZ IAS 34.16A (mandatory interim disclosures) are included elsewhere in the interim financial statements (e.g. management commentary), a cross-reference is required to this information in the interim financial report.

|

NZ IFRS 14 Regulatory Deferral Accounts

NZ IFRS 14 Regulatory Deferral Accounts is unlikely to impact New Zealand entities because it only applies to first time NZ IFRS adopters that are conducting rate-regulated activities and recognise associated assets and liabilities in accordance with their current national GAAP.

This is an interim standard, pending the outcome of the IASBs comprehensive project on rate-regulated activities.

Calculation of deferred tax on an indefinite life intangible asset

At its November 2016 meeting, the IFRS Interpretations Committee clarified, for the purpose of calculating deferred tax, how an entity should determine the expected manner of recovery of an intangible asset that has an indefinite useful life. Diversity exists in practice on how entities account for this Deferred Tax Liability (DTL).

As part of the Committee’s analysis of this issue, it noted that the existing guidance in IFRS is clear that the deferred tax on an intangible asset with an indefinite life should be calculated based on how the entity expects to recover the asset, i.e. either through use or through sale.

In our view, if the adjustment to recognise a DTL on an indefinite-lived intangible asset (not previously recognised) is made in the first annual reporting period ending after November 2016, you can change your accounting policy and retrospectively restate your financial statements in accordance with NZ IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors. However, if you do not make the adjustment in the first annual reporting period after November 2016, you will need to recognise the adjustment as an error in accordance with NZ IAS 8.

Simple example

During the current financial year, Company A purchased Company B’s business, including all of its operations, stores and brand names which it intends to use. This transaction meets the definition of a business combination under NZ IFRS 3 Business Combinations.

As part of the purchase price allocation, brand names are assigned a fair value of $500 million.

The carrying amount of the brand name in the books of Company B (acquiree) is NIL.

The tax base of the brand name is NIL.

The brand names are considered to have an indefinite life under NZ IAS 38 Intangible Assets.

Company A has a 30 June 2017 year end.

Company A should recognise a DTL for the brand name because there is no exemption in NZ IAS 12 Income Taxes for recognising DTLs that arise from assessable temporary differences on a business combination.

If Company A had not recognised the DTL for the brand name that will be recovered through use, then the journal entry to record the deferred tax liability would be (assuming goodwill is not impaired):

|

Dr

|

Goodwill

|

$140 million

|

|

|

Cr

|

Deferred tax liability

|

|

$140 million

|

|

|

28% of ($500 million less NIL tax base)

|

|

|

Action points

If you have indefinite-lived intangible assets on your balance sheet from a previous business combination, consider if you have correctly recognised a DTL as part of the business combination accounting. If not, you will need to recognise a DTL based on your expected manner of recovery (i.e. through use or through sale), and retrospectively recognise this liability in your 30 June 2017 financial statements.

For more on the above, please contact your local BDO representative.