Examination of key audit matters in audit reports

The January 2017 edition of Accounting Alert included an article on the changes that have been introduced to audit reports for periods ending on or after 15 December 2016.

The article identified one of the key changes to audit reports as being the new requirement for the audit reports of listed companies to provide information on key audit matters, which are those matters that, in the auditor’s judgement, were of most significance in the audit of the current-period financial statements. For periods ending on or after 15 December 2016, the audit report of a listed entity will:

- Identify the key audit matters

- For each identified key audit matter, provide a clear, concise, understandable and entity-specific description of the matter

- In that description, state why the matter was considered to be one of most significance in the audit, explain how the matter was addressed in the audit and reference any related disclosures in the financial statements.

Some listed companies in Australia and New Zealand have early adopted the new audit report requirements, which has meant that those reports have included information on key audit matters. Chartered Accountants Australia and New Zealand (“CA ANZ”) has undertaken an analysis of early adopters of the new audit reports in Australia and New Zealand. The CA ANZ report provides an interesting insight into what we can expect from audit reports during the 2017 reporting season in New Zealand and Australia.

The CA ANZ report, Enhanced Auditor Reporting – One Year On, identified 28 reports released prior to 31 August 2016 that included key audit matters – 20 of those reports were issued in Australia, while eight were issued in New Zealand.

The CA ANZ report notes that the key audit matters included in the audit reports that they examined addressed a diverse range of issues and were “bespoke to each entity and its industry”.

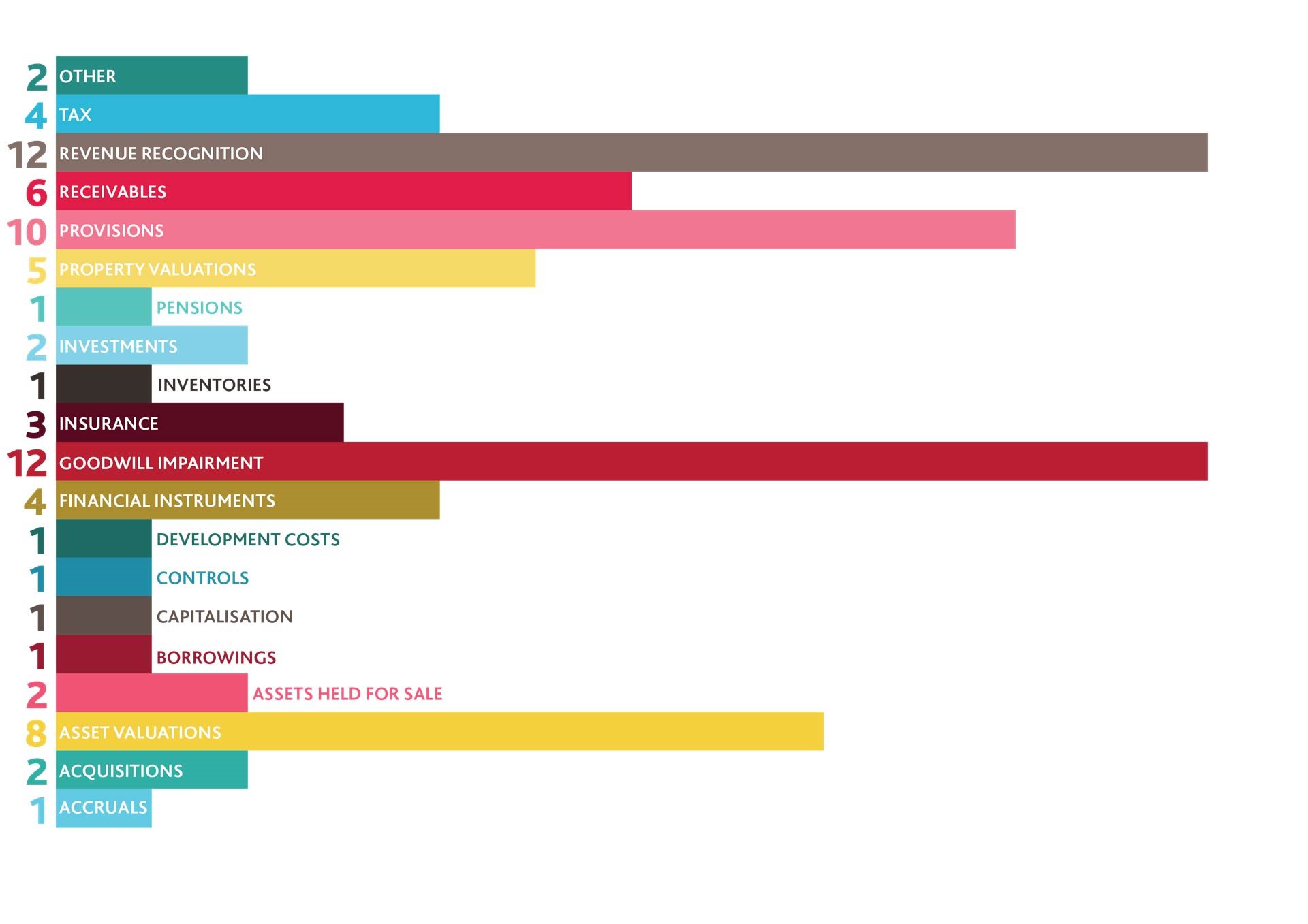

The key audit matters and the number of times they were raised related to the following issues:

As shown above, there were a number of key audit matters that appeared in the audit reports of several companies. Impairment of goodwill, revenue recognition, provisions and asset valuations were common key audit matters. However, the CA ANZ report noted that, even where a matter was identified as a key audit matter in a number of audit reports, the discussion of that key audit matter was different in each of those audit reports, due to the unique circumstances of each of the companies to which that key audit matter related.

As we move into the 2017 reporting season in New Zealand, the inclusion of key audit matters in the audit reports of listed companies will provide investors with insight that they have previously not had into the matters that were of most significance to the auditor. This information is likely to be of great interest to a number of investors. It is also likely that the process of preparing audit reports that include key audit matters will require extensive communication between auditors and audit committees.

For more on the above, please contact your local BDO representative.