As the Not-for-Profit (NfP) sector emerges from COVID-19’s complicated funding environment, organisations are taking a closer look at their financial reserves. Also known as operating reserves, these funds represent an accumulation of prior year surpluses and can act as a financial safety net.

While reserves are an extremely important piece of the NfP funding puzzle, there can be a lack of clarity around them: how much should you have, how much do other organisations have, and how should you demonstrate your funding levels to stakeholders? To help navigate these questions, we’ve delved into Charities Services data to analyse the current state of reserve levels in charitable organisations across New Zealand, providing guidance on how you can manage your own reserve levels.

What role do reserves play in NfPs?

Reserves can help NfPs (also known as For-Purpose organisations) weather unexpected financial crises, meet capital costs, and make investment decisions. They’re also used to fund organisational change and improvement.

Reserves are important in terms of the message they send to supporters and funders. Organisations must strike a careful balance between showing they have enough money set aside to be financially robust, without accumulating funds in excess of the amount needed to function in the medium- to long-term within the scope of their charitable purpose. Funders want to know an NfP is achieving its mission while still maintaining a sufficient contingency fund, which makes it critical to carefully manage reserve levels.

For more information about the role reserves play, see our detailed guide here.

Reserves and COVID-19

The pandemic played a key role in highlighting the need for reserves. The unexpected event meant that many NfPs lost donations and volunteers overnight, but costs to run the entity did not suddenly cease. Some NfPs were in a slightly better position in that they had fixed funding contracts but there were still concerns around what was next and how to continue service levels in an unprecedented situation.

Interestingly, data shows that in general, funding decreased in 2020 but in 2021 it had increased to levels higher than in either 2018 or 2019. This suggests that funds received for the pandemic were held on balance sheet and only released once it was certain that the service or goods had been delivered, which then pushed the funding into the 2021 reporting year, rather than 2020. Many NfPs didn’t know in the early days of the pandemic whether funding that was on an annual contract would be renewed, and this was where reserves could be used to plan for those ‘what if’ scenarios.

A snapshot of reserve levels across New Zealand NfPs

To understand more about your own reserve levels, it can be helpful to see what’s happening elsewhere in the NfP sector.

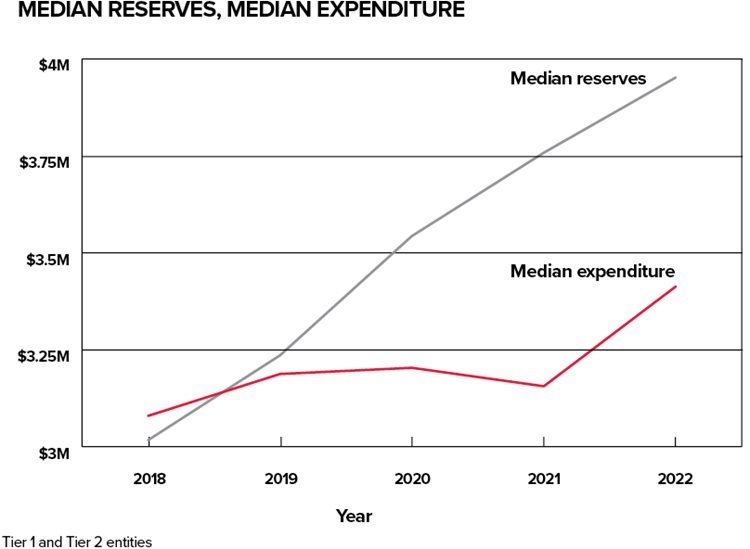

The pandemic has clearly played a significant role in the overall financial performance of NfPs in the past few years. When looking at Charities Services annual returns data for years ending 2018-2022, a few interesting trends emerge. While median income has increased, which may be due to increased direct funding or other ways that NfPs have pivoted and found new income streams, median expenditure is also increasing, particularly in the people space where pay rates have been increasing year on year.

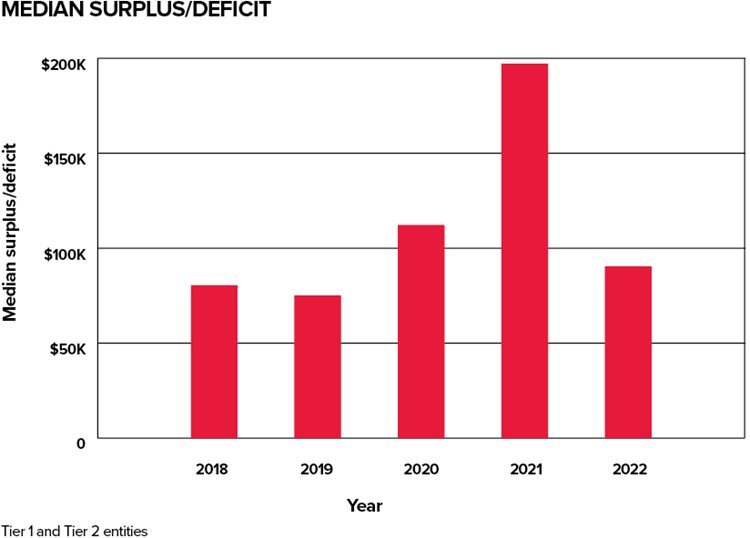

When we consider Tier 1 (organisations with over $30m annual expenses or public accountability) and Tier 2 (organisations with under $30m annual expenses) entities, the median surplus remains at $75k to $112k except in 2021, which had a median surplus of $197k. This may have been due to the pandemic funding, which saw a small rise in the median surplus in 2020 or may have come from the start of additional pandemic funding not fully utilised by the reporting year-end of many NfPs.

This then continued in 2021, which as discussed above, may be due to a timing difference between funds being received for the pandemic and those funds being utilised and released to revenue, especially as expenditure dropped in 2021 back to 2019 levels after a slight increase in 2020.

Note: The graphs in this article have been created using Charities Services annual returns data for registered Tier 1 and Tier 2 organisations in New Zealand from the years ending 2018-2022.

Graph 1: 2021 surplus increase may be due to pandemic funding

Regardless of the above, the median surplus amounts suggest that funding is only just covering costs and does not leave a significant amount of extra resource to build reserves. A conscious effort by NfP organisations needs to be made each year to gain increases in reserve balances.

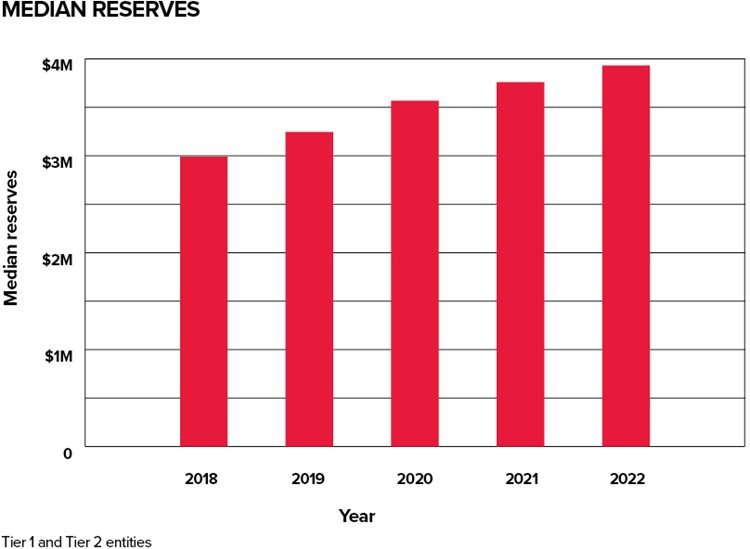

On the positive side, reserves have been steadily increasing each year which suggests that there is a genuine effort within the NfP sector to provide services within the scope of the funding provided to them and to grow reserves in case of future unexpected challenges.

Graph 2: Reserves steadily increase as NfPs look to protect against future challenges

We can see that median reserve increases remain in excess of median expenditure increases each year, which suggests that NfPs are working hard to contain expenditure increases. Nonetheless for some NfPs where building reserves is more challenging, they may not have as much ability to manoeuvre if costs increased, or funding suddenly stopped or was delayed.

Graph 3: NfPs work to keep expenditure increases below reserve increases

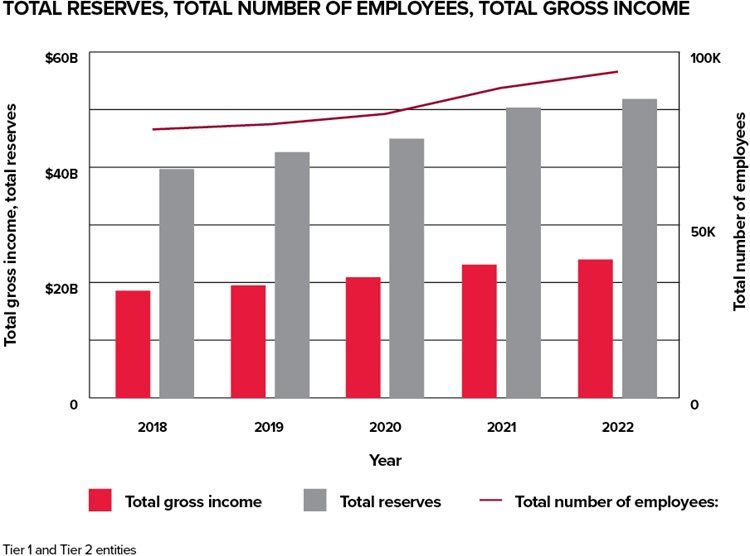

Looking closer at the impact COVID-19 has had on organisations, we can see that there has been a significant jump in gross income across the sector between 2020 and 2022, when total Tier 1 and 2 gross income levels went from $20.90bn in 2020 to $24.03bn in 2022. Reserves also increased in line with this increase in gross income.

However, we note that when we consider the breakdown of funding types there is still a significant reliance on grants and koha, with the next main source of funding coming from membership fees. This means there may be a reliance on income that a NfP may not be able to control and influence directly, particularly through times of political or economic change.

Graph 4: Gross income and total reserves jump between 2020 and 2022

Note: The raw data from these graphs has been gathered from publicly available information released by the Charities Services. It is not BDO-audited or approved.

We expect to see funding amounts either level out or reduce back towards historical norms in 2023 and 2024, but what about reserves? There is a chance these will start to drop in line with decreased funding since some expenditure has now been set at higher rates, particularly in the case of salaries and wages. This may mean those small surpluses noted above could tend towards minor deficits which will take a toll on reserve values. There is also a chance that some projects from the pandemic have had funding allocated to revenue, but expenses are still ongoing and will not show until at least the 2023 year.

We are seeing some NfPs starting to consider alternative funding options to diversify revenue streams and help keep the NfP financially viable. One option could be to evaluate whether sponsorship could find mutual gains between two organisations with similar goals. At BDO, we’ve produced a sponsorship matrix of questions to consider when evaluating whether this type of mutual partnership will add value.

What level of reserves should your NfP aim for?

For-Purpose organisations often ask us what level of reserves they should aim for, and while there’s no one-size-fits-all figure, there is some general guidance that can help.

As a rule of thumb, most organisations use a three-to-six-month operating expenditure figure as a starting point for their reserves. This is tailored to suit their individual circumstances.

Minimum and target reserves

Many organisations choose to set minimum and target reserve levels. A minimum net asset reserve level demonstrates a Governing Board’s direction and can be monitored against actual reserve levels to gauge when intervention is required. A minimum reserve level may be made up of a contingency amount and an asset replacement amount and can be scaled in accordance with the size of the organisation and the Board’s appetite for risk.

A target reserve level is typically higher than the minimum level and can be made up of a contingency amount, asset replacement figure, and allowance for special projects. If this target level is exceeded, organisations should carefully consider what value would be added by building up further reserves.

The amount of reserves are often dictated by the risk of funding delays within the organisation as well as the type of expenditure that needs to be protected. We have prepared a score sheet that could be used to evaluate the level of reserves.

More information

At BDO, we're increasingly seeing funders asking to look at NfPs' balance sheets, reserves, and Statements of Service Performance (SSPs). Keeping a close eye on these will ensure your organisation is better positioned to secure funding and remain successful into the future.

Read our recent article on how you can maximise your SSP here.

For more assistance on understanding your reserves, reach out to our Not-for-Profit team here.