CORPORATE GOVERNANCE DISCLOSURES REVIEWED

27 October 2016

In the October 2015 edition of Accounting Alert, we examined the Financial Markets Authority’s (“FMA’s”) handbook, Corporate Governance in New Zealand: Principles and Guidelines (“the Guidelines”). The Guidelines outline nine principles of good corporate governance and provide information on how to apply those nine principles.

The FMA has recently undertaken a review of corporate governance disclosures against the principles in the Guidelines. The review examined the annual reports and websites of a selection of both listed and unlisted companies. In total, 45 companies were reviewed – 26 of those companies had securities registered on an NZX exchange and the remainder were unlisted companies selected from the Financial Service Provider Register. For each company reviewed, the FMA sought answers to questions related to each of the nine principles identified in the Guidelines.

Overall, the FMA found that companies listed on the NZX provided substantially more corporate governance information than unlisted companies. On average, listed companies disclosed 67% of all the information recommended in the Guidelines, while unlisted companies only disclosed, on average, 24% of the information.

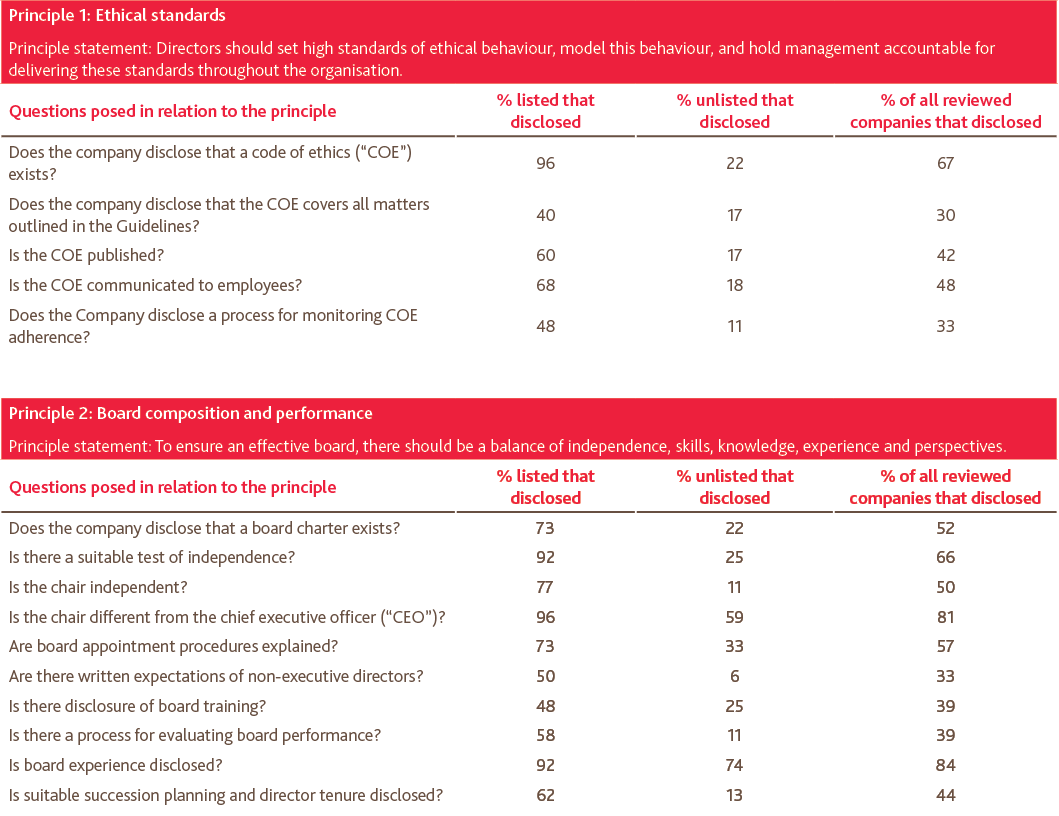

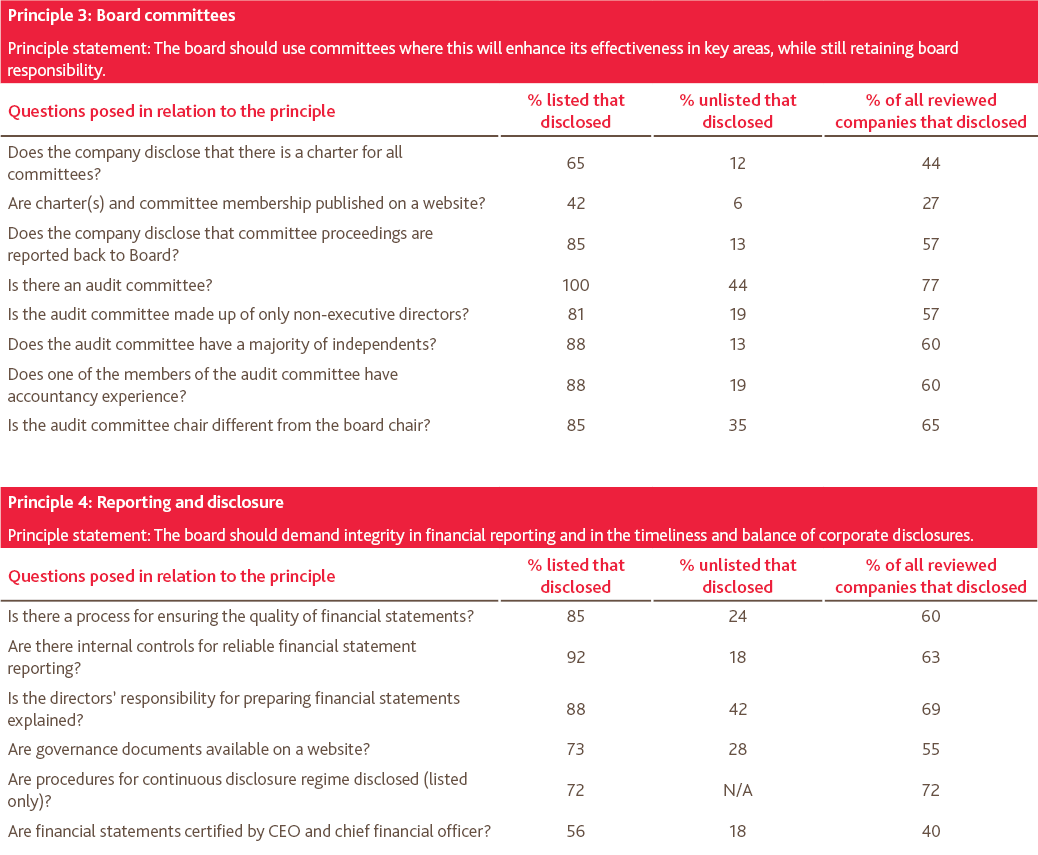

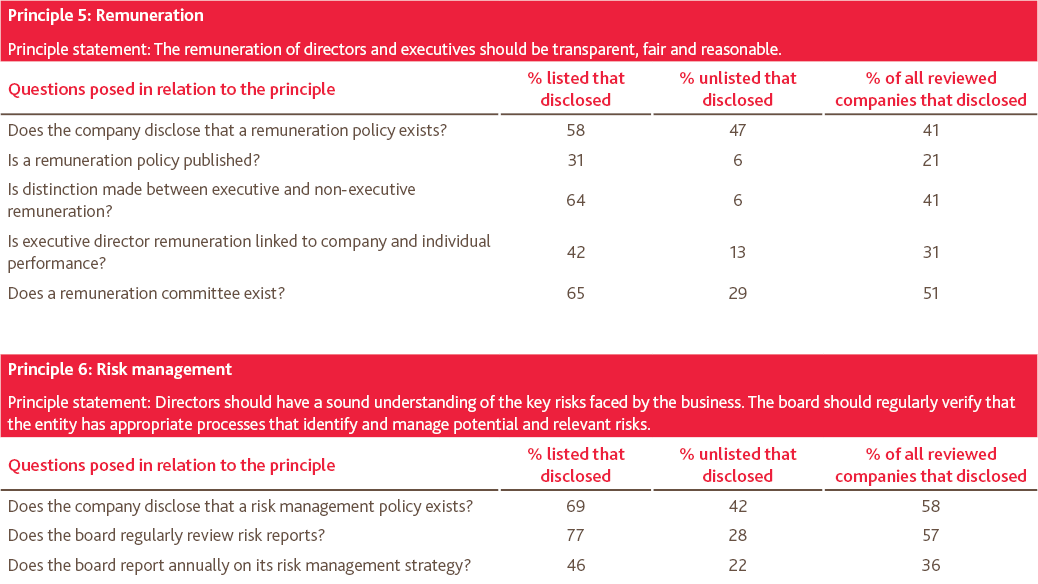

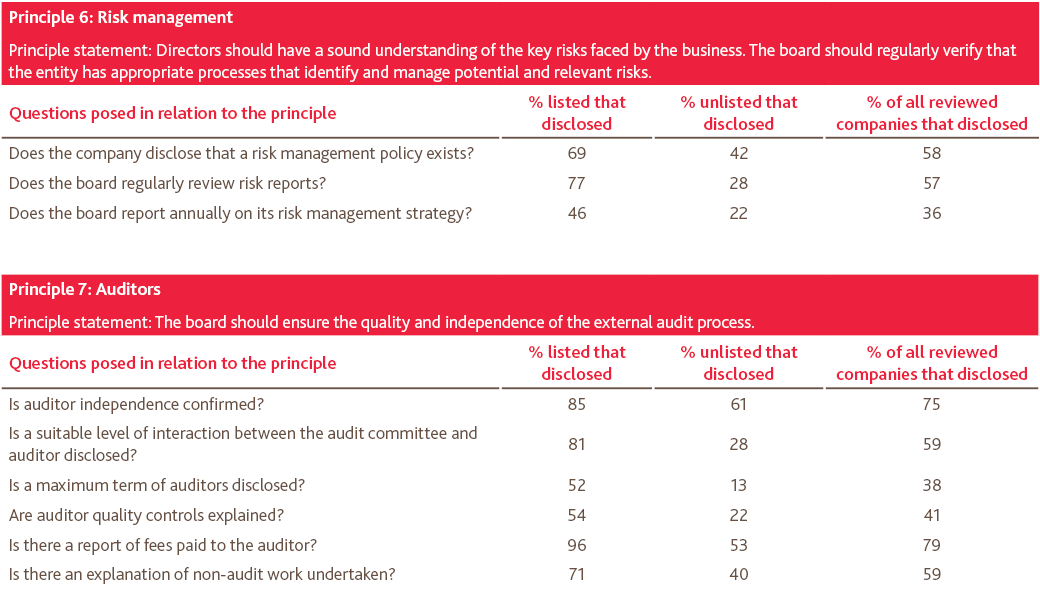

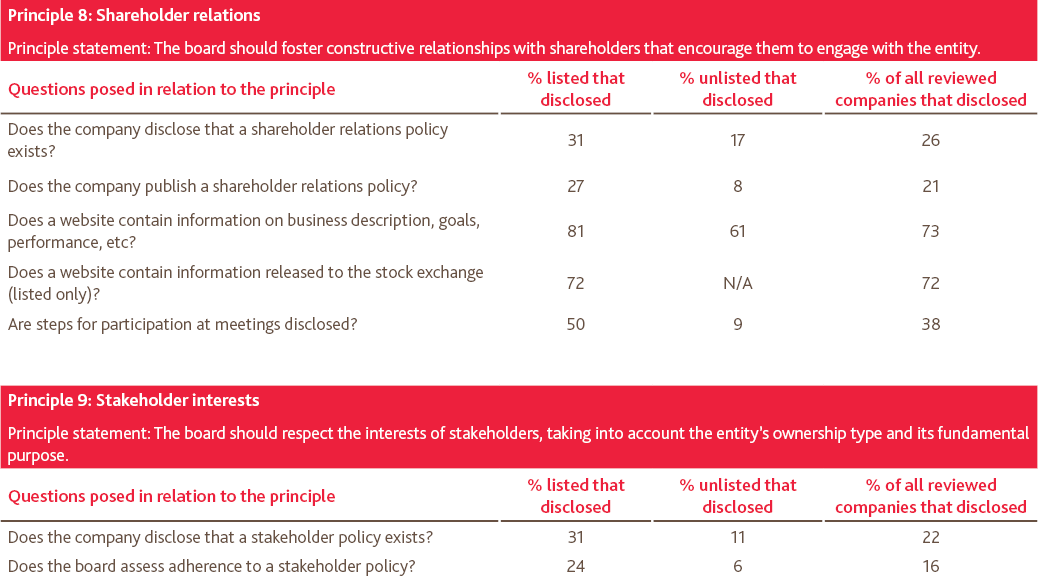

More detailed information on the questions posed in relation to each principle, and the FMA’s findings for each question, is provided below.

Of the nine principles outlined in the Guidelines, stakeholder interests had the lowest reporting (19%), followed by reporting on remuneration (37%).

As a result of its review, the FMA is encouraging:

- Unlisted companies to improve their corporate governance reporting

- All companies to improve their corporate governance in relation to stakeholder interests and reporting on remuneration.

The full review is available.

For more on the above, please contact your local BDO representative.