Accounting for revenue under IFRS 15 – The complexity of contract modifications

In our May 2018 edition of Accounting Alert we discussed the five step model for revenue recognition introduced by IFRS 15 Revenue from Contracts with Customers (“IFRS 15”):

| Step 1 |

Identify the contract(s) with the customer |

| Step 2 |

Identify the performance obligations in the contract |

| Step 3 |

Determine the transaction price |

| Step 4 |

Allocate the transaction price to the performance obligations |

| Step 5 |

Recognise revenue when a performance obligation is satisfied |

In our mid-June 2018 edition we then examined the first step in greater depth and identified three potential difficulties that can arise in relation to that step:

- Determining whether a contract exists

- Deciding whether multiple contracts need to be combined, and

- Determining how to account for a modification of a contract.

We addressed the first two of these three issues in our mid-June 2018 article and this month we address the third of these potential difficulties.

Determining how to account for a modification of a contract

Contract modifications are changes in the scope and/or price of an existing contract (i.e. they create new, or amend existing, enforceable rights and obligations).

There are three possible outcomes when a contract is modified:

- The modification is accounted for as a separate contract

- The modification is accounted for as a termination of the original contract and the issue of a new contract

- The modification is accounted for as a change to the existing contract.

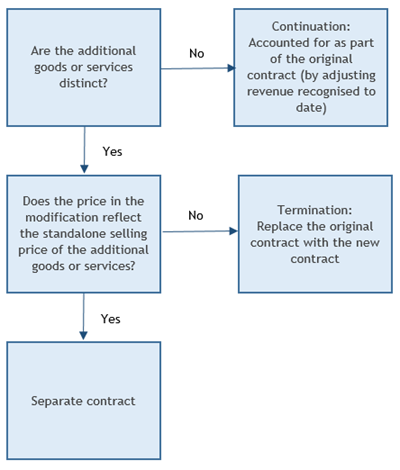

These are illustrated in the decision tree below:

A contract modification is only accounted for as a separate contract if there is both:

- A change in scope where the additional goods or services provided are distinct, and

- An increase in total contract price which reflects the standalone selling price of the additional goods or services.

If the additional goods or services are distinct, but the increase in contract price does not reflect the standalone selling price of the additional goods or services, the modification is accounted for as a termination of the existing contract and the issue of a new one.

Where the additional goods or services provided are not distinct, the modification is accounted for as a change to the existing contract (i.e. a continuation), and there is an adjustment to revenue recognised at the modification date.

The examples below illustrate the accounting for these three types of modifications.

Example 1 (separate contract)

Company A enters into a contract to sell 14,000kg of apples to a customer for $14,000 ($1.00/kg).

The apples are packaged in 1kg plastic bags (with each bag being distinct) and are transferred to the customer over a seven-week period.

Company A recognises revenue after each delivery (based on the number of 1kg bags delivered).

After Company A has transferred 8,000 1kg bags of apples to the customer, the contract is modified to require the delivery of an additional 3,000 1kg bags of the same variety of apples to the customer (i.e. there will now be a total of 17,000 1kg bags of apples delivered to the customer and 9,000 of those bags have not yet been delivered).

The price for each additional 1kg bag will be $0.95, which reflects the standalone selling price of the products at the time of the contract modification.

Question

How should Company A account for the sale of the next 2,000 1kg bags of apples to its customer?

Answer

Using the above decision tree:

- The additional 3,000 1kg bags of apples to be supplied as part of the modified contract are distinct, and

- The price to be charged for the additional 3,000 1kg bags of apples reflects of the standalone selling price of the additional goods to be provided.

Therefore, the agreement for the additional 3,000 1kg bags of apples is accounted for as a separate contract.

This means that when the next 2,000 1kg bags of apples are sold, the sale comes from the original contract (because at the date of contract modification there were still 6,000 1kg bags of apples to be sold under the original contract) and the journal entry is:

Dr Cash $2,000 (2,000 bags at $1/bag)

Cr Revenue $2,000

Example 2 (termination of original contract)

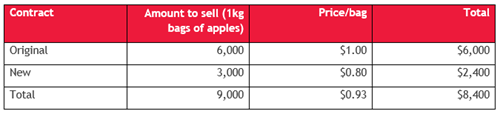

The facts are the same as for Example 1, except that the price for each additional 1kg bag will be $0.80, which does not reflect the standalone selling price of the apples at the time of the contract modification.

Question

How should Company A account for the sale of the next 2,000 1kg bags of apples to its customer?

In this scenario:

- The additional 3,000 1kg bags of apples to be supplied as part of the modified contract are distinct, and

- The price to be charged for the additional 3,000 1kg bags of apples does not reflect the standalone selling price of the additional goods to be provided.

Therefore, the agreement for the additional 3,000 1kg bags of apples is accounted for as a termination of the original contract and a creation of a new contract.

On that basis, as 8,000kg have already been sold under the original contract, the remaining sales under the two contracts will be:

The amount of revenue that will be recognised for each bag sold after the contract modification is $0.93 ($8,400/9,000 bags). However, the amount that the customer will pay for each bag sold after the contract modification will be based on the contractual terms, i.e.:

- For the first 6,000 bags sold, the customer will pay $1/bag (per the terms of the original contract - at the time of contract modification, 6,000 bags of the original 14,000 bags had not been sold)

- For the final 3,000 bags sold, the customer will pay $0.80/bag (per the terms of the modified contract for the additional products).

When an additional 2,000 bags are sold, the journal entry is:

Dr Cash $2,000 (2,000 bags at $1/bag received from the customer)

Cr Revenue $1,860 (2,000 bags at $0.93/bag)

Cr Revenue received in advance $140 (balancing figure)

Example 3 (continuation of the existing contract)

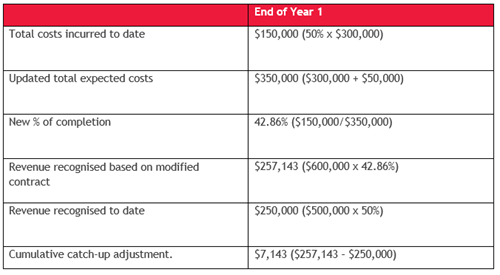

On 1 January 2019, a customer engages Construction Co to provide construction services to build a house for $500,000 (estimated cost $300,000). On 1 January 2020, Construction Co and the customer agree to modify the contract to rearrange the layout of the kitchen and bathroom for an additional $100,000 (estimated cost $50,000).

Construction Co has been recognising revenue on a stage of completion basis and at 1 January 2020, 50% of the original contract value has been completed.

Question

How should this contract modification be accounted for?

Answer

The modified kitchen does not represent a good or service that is distinct so Construction Co needs to continue the contract and adjust revenue recognised to date via a cumulative catch up adjustment.

The following journal entry will be processed by Construction Co on 1 January 2020:

|

Dr

|

Trade receivable

|

$7,143

|

|

|

Cr

|

Revenue

|

|

$7,143

|

Concluding thoughts

Contract modification under IFRS 15 is complex and requires accounting teams to apply considerable professional judgement and have an in-depth understanding of the standalone selling prices of their company’s goods and services. It also requires accounting teams to work closely with sales teams, so that they are promptly notified of contract modifications.

Accounting for contract modifications under IFRS 15 can result in invoices billed to customers not necessarily being recognised as revenue in the same period, which may require explanation in the financial statements. Where employee remuneration is based on revenue, consideration will have to be given to whether remuneration will be based on revenue recognised or payments received from customers.

As companies move to adopt IFRS 15, it will be important for accounting teams to develop processes for ensuring that they are promptly notified of contract modifications, and to ensure that the terms and conditions of forms of employee remuneration linked to revenue are updated to address the implications of IFRS 15 adoption.

For more on the above, please contact your local BDO representative.