What’s new for 31 December 2018 financial statements?

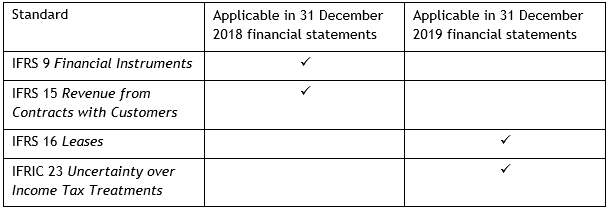

Over the last few years there has been considerable discussion about upcoming changes to financial reporting requirements for both Tier 1 and Tier 2 for-profit entities (i.e. entities reporting under New Zealand equivalents to International Financial Reporting Standards (“NZ IFRS”) or NZ IFRS Reduced Disclosure Regime). As shown in the table below, the first balance date to which some of these new requirements apply has now passed:

Preparers of 31 December 2018 financial statements will need to ensure that they correctly transition to IFRS 15 Revenue from Contracts with Customers (“IFRS 15”) and IFRS 9 Financial Instruments (“IFRS 9”).

Transition – IFRS 15

IFRS 15 allows a number of different transition methods. More information on those transition methods is provided in the January 2017 edition of Accounting Alert. The choice of transition method is important, as different methods can have different impacts on assets, liabilities and retained earnings, which in turn can have a significant impact on an entity’s ability to pay dividends and meet bank covenants.

Transition – IFRS 9

It is expected that most entities will make any transition adjustments on first-time adoption via opening retained earnings on 1 January 2018 (i.e. that they will not restate comparatives).

Disclosure

|

IFRS 9, via IFRS 7 Financial Instruments: Disclosures (“IFRS 7”), and IFRS 15 both include significant new disclosure requirements. As a result, rolling over reporting templates from prior years will not suffice.

|

In addition to providing the new disclosures required by IFRS 7 and IFRS 15 on an ongoing basis, on transition entities will need to consider how to present the effects of changes in accounting policies resulting from the adoption of these new standards. In this regard, entities should refer to the requirements in:

- IFRS 7, paragraphs 42I to 42S, for transition disclosures on financial instruments

- IFRS 15, Appendix C, for information on the transition to IFRS 15

- IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors (“IAS 8”), paragraph 28.

Other amending standards and interpretations

In addition to IFRS 9 and IFRS 15, the following amending standards and interpretations apply for the first time to Tier 1 and Tier 2 for-profit entities with December 2018 year-ends (except as noted below):

|

Standard/interpretation name

|

Covers

|

|

Classification and Measurement of Share-based Payment Transactions (Amendments to NZ IFRS 2)

|

Clarifies the following accounting under NZ IFRS 2 Share-Based Payment:

- The impact of vesting and non-vesting conditions when measuring cash-settled share-based payment transactions

- Net settlement features for withholding tax obligations

- Changing the classification of share-based payment transactions from cash-settled to equity-settled.

|

|

Applying NZ IFRS 9 Financial Instruments with NZ IFRS 4 Insurance Contracts (Amendments to NZ IFRS 4)

|

- Provides insurers with a temporary exemption to continue to apply IAS 39 Financial Instruments: Recognition and Measurement for annual periods beginning before 1 January 2021

- Permits an “overlay approach” to designated financial assets.

|

|

Transfers of Investment Property (Amendments to NZ IAS 40)

|

Amendments to IAS 40 Investment Property to clarify when transfers can take place into, and out of, investment property.

|

|

NZ IFRIC 22 Foreign Currency Transactions and Advance Consideration

|

Clarifies the date of the transaction for the purposes of translating foreign currency transactions where consideration is received or paid in advance under IAS 21 The Effects of Changes in Foreign Exchange Rates.

|

Disclosing the impact of new standards that only apply from 2019

Where an entity has not applied a new IFRS that has been issued, but is not yet in effect, IAS 8 requires the entity to disclose known or reasonably estimable information relevant to assessing the possible impact that application of the new IFRS will have on the entity’s financial statements in the period of initial application. This disclosure should include quantification of the impact of adoption to the extent possible (and such quantification should be possible in the year prior to adoption).

Entities will need to ensure that these disclosures are made in relation to the adoption of IFRS 16.

For more on the above, please contact your local BDO representative.