IFRS 16 set to have substantial impacts on the financial statements of lessees

In the May 2018 edition of Accounting Alert we noted that IFRS 16 Leases (“IFRS 16”), which comes into effect for financial reporting periods beginning on or after 1 January 2019, will fundamentally change the manner in which lessees account for leases.

The following example of a simple building lease demonstrates just how significant that change will be.

Example:

Lessor Company owns a building that it agrees to lease out to Company A under a lease with the following terms:

- The lease will be for a period of five years

- The annual rental will be $155,000, payable annually in arrears

- Lessor Company will give Company A $100,000 cash prior to the commencement of the tenancy to enable Company A to fit out the premises to Company A’s specifications.

Company A’s incremental cost of borrowing is 5.9%. There are no initial direct costs, prepayments or restoration costs associated with the lease.

The present value of annual rentals of $155,000 payable annually in arrears at a discount rate of 5.9% is $654,696.

The information provided below summarises how the accounting differs under IAS 17 Leases (“IAS 17”) and IFRS 16.

IAS 17

Under IAS 17, Company A recognises the lease expense, net of incentives provided by Lessor Company, on a straight-line basis over the term of the lease.

The total rent payable over the five-year lease term is $675,000 ([$155,000 x 5] - $100,000). The annual lease expense is therefore $135,000 ($675,000/5).

The journal entries are as follows:

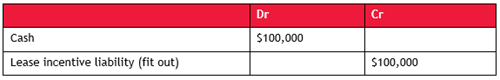

Inception of the lease

End of year one

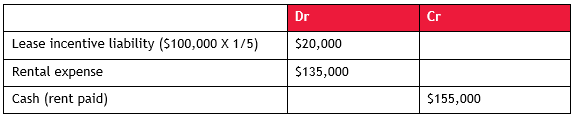

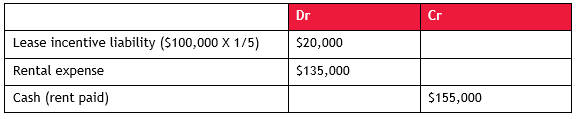

Years two to five

IFRS 16

At the commencement date of a lease being accounted for under IFRS 16:

- The lessee must recognise a right-of-use asset and a lease liability

- The lease liability must be measured at the present value of the lease payments that are not paid at that date

- The right-of-use asset must be measured at cost, which is the sum of:

- The amount of the initial measurement of the lease liability

- Any lease payments made at or before the commencement date, less any lease incentives received

- Any initial direct costs incurred by the lessee

- An estimate of costs to be incurred by the lessee in dismantling and removing the underlying asset, restoring the site on which it is located, or restoring the underlying asset to the condition required by the terms and conditions of the lease (unless those costs are incurred to produce inventories).

Following initial recognition, the lessee must measure the lease liability by:

- Increasing the carrying amount to reflect interest on the lease liability

- Reducing the carrying amount to reflect the lease payments made

- Remeasuring the carrying amount to reflect any reassessment or lease modifications, or to reflect revised in-substance fixed lease payments.

Following initial recognition, a lessee must generally measure the right-of-use asset by applying the cost model (i.e. cost less accumulated depreciation and accumulated impairment losses).

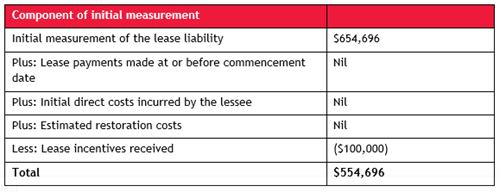

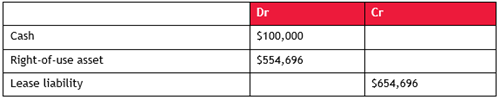

Therefore, for Company A, at the inception of the lease the lease liability is $654,696 (the present value of the lease payments) and the right-of-use asset is $554,696, calculated as follows:

At the commencement of the lease, Lessor Company pays Company A $100,000 cash. This means that Company A’s journal entry at the inception of the lease will be:

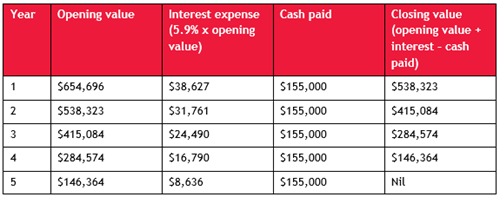

Each year, Company A will make a cash payment of $155,000. The lease liability will decrease over the period of the lease as follows:

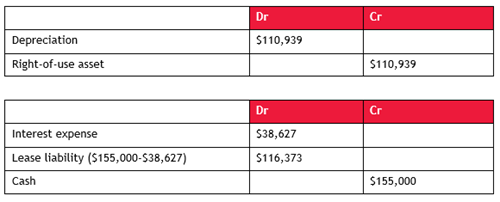

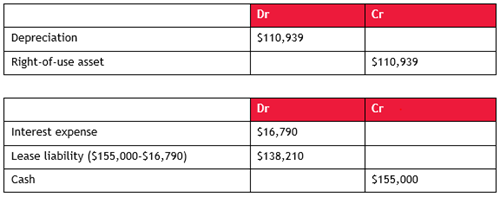

Assuming no impairment of the right-of-use asset, and the depreciation of the right-of-use asset on a straight-line basis over the five-year lease period, the right-of-use asset will decrease by $110,939 ($554,696/5) in each year of the lease.

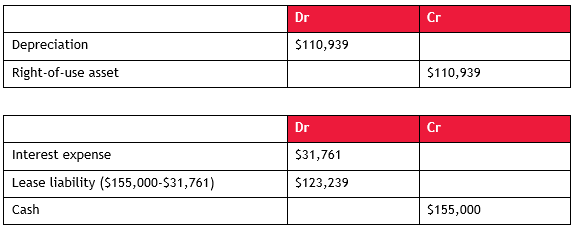

The journal entries over the remaining period of the lease are as follows:

End of year one

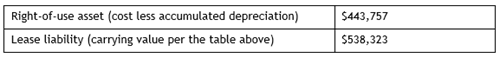

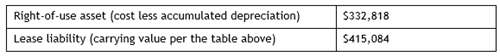

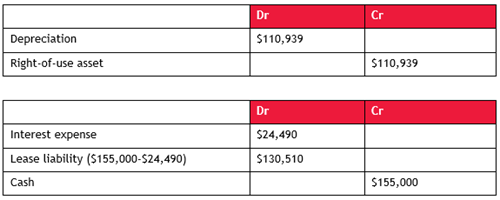

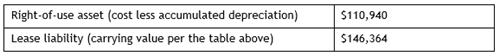

At the end of year one, Company A will have the following right-of-use asset and lease liability:

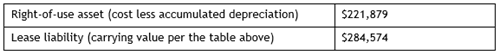

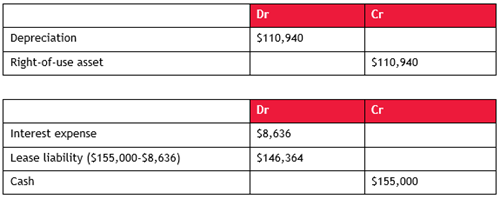

End of year two

At the end of year two, Company A will have the following right-of-use asset and lease liability:

End of year three

At the end of year three, Company A will have the following right-of-use asset and lease liability:

End of year four

At the end of year four, Company A will have the following right-of-use asset and lease liability:

End of year five

At the end of year five, Company A’s right-of-use asset and lease liability will both have been written down to nil.

Concluding thoughts

As can be seen from the example above, the introduction of IFRS 16 will have a substantial impact on the financial statements and key financial metrics of lessees:

- Statement of financial position ratios will change due to the recognition of right-of-use assets and lease liabilities

- The current year portion of the lease liability will be a current liability, which will impact working capital and associated ratios

- The even lease expense recognised under IAS 17 will be replaced by interest expense (which will decrease over time) and depreciation – this will mean a larger impact on profit or loss at the beginning of a lease than at later stages of a lease

- Earnings before interest and tax (EBIT) and earnings before interest, tax, depreciation and amortisation (EBITDA) will increase due to an operating expense being replaced by depreciation and interest expense

- An operating cash flow for lease payments will be replaced by a financing cash flow for the reduction in the lease liability and an operating or financing cash flow for the interest expense.

In addition, the adoption of IFRS 16 will require additional investment in human and technological resources, in particular for those entities that are lessees in a large number of leases or where there are complex lease calculations.

For more on the above, please contact your local BDO representative.