It’s difficult to disagree with the notion that a tax system, amongst other things, should be fair. This is part of the remit of the Tax Working Group and a renewed call from Ministers to focus on inequity of the tax system.

We also have the stories of Google, Starbucks, Amazon etc and how little corporation tax they pay is not new and the tax legislators around the world are fighting against this corporate inequity (via the Base Erosion and Profit Shifting programme).

The inequity of not paying tax.

But what about inequity going the other way? Is it fair that effectively tax can arise on the same income twice?

Let’s consider two scenarios:

Emily is the sole owner of Jessica Limited. Jessica Limited is very successful in New Zealand and pretty much owns the market. Sales are $500,000, net profit before tax of $200,000. It’s all domestic.

To contrast, James is the sole owner of WD Limited. It too is successful, but on an international scale. WD Limited has no New Zealand sales, but has significant activities in Australia and has sales of $500,000, net profit before tax of $200,000. It’s all overseas.

All persons and companies are New Zealand tax resident, but the important difference is that due to the scale of operations in Australia is that WD Limited has an income tax liability in Australia. The final piece in the puzzle is that Emily and James take an annual dividend each year to the maximum amount possible.

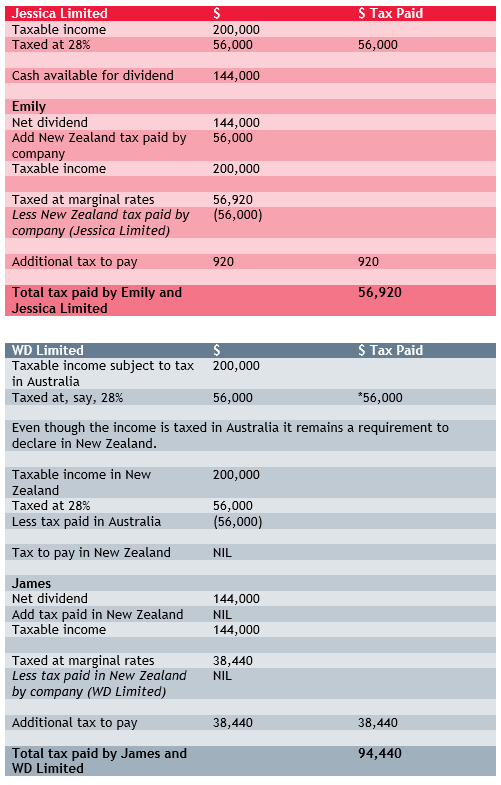

They say a picture paints a thousand words, I’ll paint by number to highlight the issue (various assumptions are made, but they should be obvious):

Income tax returns

The income tax position is illustrated individually, then also combined, i.e. the tax position is contrasted by economic group (i.e. Emily and Jessica Limited verses James and WD Limited).

* This is tax paid in Australia to the Australian Tax Office, and is not tax paid in New Zealand.

This picture is not necessarily pretty, but it does highlight the issue. In both scenarios there is a total of $200,000 of income, yet one pays $56,920 of tax, the other $94,440. The effective tax rate increases significantly from 28.46% to 47.22%.

And the reason for the double tax is the entrepreneurship of WD Limited in exploring markets further afield than New Zealand. Ironically, the New Zealand system which seeks to prevent double tax to shareholders of companies is a little bit xenophobic, as it only passes on tax paid in New Zealand to shareholders.

If a New Zealand company pays tax elsewhere other than in New Zealand, double tax can arise if the profits on the overseas taxable income is sought to be returned to the New Zealand shareholder. There’s a big discussion here (starting with affordability), but this could be argued as equally as unfair as not paying tax at all.

For more information, contact your local BDO Tax advisors.