Throughout this year, our risk advisory team has provided us with insights on the top priorities and trends that directors, executives, and business owners alike should be aware of.

The first several months of this year’s COVID-19 crisis made it clear that those businesses with risk management strategies in place were in a better position to adapt to the pandemic, but how has this borne out over time, and what does it mean for the future? Now that the year is coming to a close, we have a better vantage point to analyse the current climate of business in NZ and make some suggestions for overcoming the challenges of next year.

In truth, many businesses are still in survival mode. It’s natural to react cautiously to world events such as the one we’re living through, but there’s still more to be done to future-proof a given company, regardless of industry or size. To find out what these next steps are, read on.

1. Prioritise risk management

To put things frankly, businesses across the globe are now more intimately familiar with risk management than they ever wanted to be. We understand how polarising this topic can be. No one finds imagining worst-case scenarios enjoyable, especially when it’s your business on the line. In a perfect world, companies wouldn’t have to prioritise risk management at all, but risk is an intrinsic part of doing business, and always will be, even when things are going as well as possible.

We’ve found that businesses tend to either see risk management as a critical discipline or largely un-needed, that is, something that needs to be ticked off as part of running a company with little actual analysis behind it. While it depends on the specifics of a given company and industry, we tend to find that the truth is somewhere in the middle—managing risk isn’t the holy grail, but ignoring it leaves you with dangerous blind spots.

COVID-19 has helped shift more people away from the idea that it’s unnecessary, but it’s still not considered a normal part of structuring an enterprise. It is imperative, however, that it’s woven directly into the basic decision-making process at every level.

As an example, let’s say you have a risk register. You’re aware of several situations you want to avoid, and you track them closely, perhaps you review a risk report once a year. The reason this won’t work in the long-term is that it only provides your board with the ‘what’—it’s a collection of data, but it’s un-analysed. By itself, it doesn’t really mean anything. Simply collecting data isn’t enough; to be successful in times of crisis, you need to use it. If there’s no one doing anything about the risks you’re tracking, why track them? You don’t want raw information, you want insight, and the difference is being able to create strategies that respond to your risks.

Ultimately, risk management isn’t just about mitigating potential disasters; it’s about being ready to grow through them. Risk management can become a tool that you can use to achieve your strategic goals, not just something you have in place as a shield. Think more about using it to move forward, rather than staying on the back foot.

2. Redefine strategic direction

As you’ll learn in this article, all three of the areas that directors and executives should focus on are linked. In many ways, they all need to be carried out at once, as they all have the potential to powerfully inform each other.

As you’ll learn in this article, all three of the areas that directors and executives should focus on are linked. In many ways, they all need to be carried out at once, as they all have the potential to powerfully inform each other.

This next point is a good example of how that symbiosis works: redefining your strategic direction requires more robust risk management practices than a single, annual risk report. In the same vein, altering your strategic direction can also broaden the scope of the risks you’ll need to manage.

The cornerstone of this point is flexibility, and this is another factor that businesses in NZ have suddenly had to grapple with in response to COVID-19. However, flexibility is a relatively nebulous idea, and it’s much easier said than done. So, what does flexibility look like in practice for you and your business?

Often, flexibility is the realisation that your current strategies are no longer fit for purpose. We’ve heard a lot about businesses finding that they need to re-imagine their basic structure due to social distancing, but this also includes those businesses who have found that it’s more likely that their strategies were out of date years before COVID-19 was a factor at all. For some, weathering the storm has revealed core weaknesses, but this is a good thing, because it’s a fantastic opportunity to fix them.

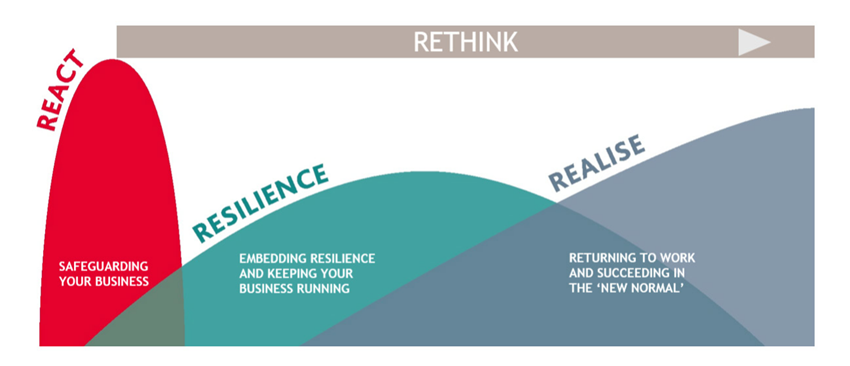

To do this, leadership teams need to think ahead. This means resisting the urge to stay focused on the short-term alone, and consider long-term strategies, even when it seems like it’s not a priority. Rather than focusing on one or the other, you need to put in the effort to focus on both. Ask yourself, if changes have been made already, how can they be maintained? How can they help you achieve your strategic goals? These are the sorts of questions that our RETHINK model helps outline, by creating a structure for planning on multiple timelines; short-term, medium-term, and long-term.

Another resource which can help is our new whitepaper; Risk in 2020: Insights for Kiwi Businesses, which delves into current challenges for businesses across the globe.

3. Govern for purpose

The final focus area for 2021 is governing for purpose—what is your purpose beyond profit? Over the past few decades, the purpose of business has changed. Structuring your approach around sales, costs, and profits, and nothing else will not play out in your favour. For those who have been in business for a long time, this doesn’t seem possible, but it’s true—many businesses can’t afford to continue focusing on the bottom line alone.

This can be a difficult hurdle, but it’s a key issue, and it’s something which is only going to become more important. We live in a world driven by ongoing megatrends; shifting economic power, climate change, and wealth disparity to name just a few. These things change how people behave on a fundamental level, and these behavioural patterns need to be considered.

"By creating a business with a clear purpose, you build a critical advantage over the competition."

This has been true for some time already, but we’re seeing more and more value come out of it. Coming up with a sustainable advantage can seem like an insurmountable task, but the trick here is to think big. Who are your stakeholders in the widest possible sense? Go beyond shareholders, and include your employees, their families, and the communities that you’re all a part of. What can you offer them? What should you offer them?

Governing for purpose can be thought of as creating a legacy, but it’s also about building a culture. What are your values, and what do you want to share with the communities around you?

"Once you know where you stand on this front, the first two points can begin to fall into place too—your purpose informs your strategic goals, and risk management helps you achieve those goals, bringing you closer to your overall purpose."

Let us help you succeed in 2021

No matter who you are, BDOs accountants in Auckland have the expertise to help you build a business that lasts. Even smaller owner-operator businesses—New Zealand’s economic engine—can benefit from the points discussed above. Risk management isn’t one-size-fits-all; it scales to create smaller frameworks for smaller teams.

If you’d like to know more about how we can help you to implement a value-adding risk management framework, reset your strategy, or fine-tune your governance culture, talk to one of our

Risk Advisory specialists today. Don’t stay reacting, start acting.