Momentum is strong in the New Zealand economy. We have a booming tourism sector and recovering dairy sector, together making up around 12% of GDP, and a buoyant residential and commercial property sector.

You only need to look at the number of cranes on the Auckland and Christchurch skylines and apartment advertisements in Auckland to realise that. Residential prices have continued their growth as demand outstrips supply due to record net migration and the buoyant economy.

As they say, New Zealand is on a roll.

So how do you reconcile that with some recent high-profile collapses such as Pumpkin Patch, Wynyard, shirtmaker Nicholas Jermyn, Dick Smith, Valleygirl and Temt; with rumours circulating on several others … not to mention several planned apartment developments that have recently been abandoned due to cost escalation and failure to raise finance?

Well, even in strong economic conditions, businesses fail. This can be due a range of factors from poor management and governance, timing, failure to successfully address legacy issues and technological disruption, through to strong competition or growing too quickly.

But for every collapse there are many more businesses that have successfully navigated challenges and turned themselves around. These tend to fly under the radar due to the importance of confidentiality when faced with challenges.

Here we focus on some of the learnings from some successful restructurings and turnarounds we've been involved in.

Acting Early

First, the appropriate action will depend on the circumstances. Typically, the earlier you identify the warning signs, the more options you will have available. That is why it is so important to have strong timely information available that is reviewed by the appropriate stakeholders. Whether it be real-time sales and margin data for sales reps or monthly board and management reporting packs showing monthly and year-to-date performance along with financial and non-financial KPIs. The key is that it needs to be available as quickly as possible and needs to be accurate, because it will be used for staff, management and directors to make decisions. Recent developments in systems can facilitate this including add-on apps that are available often at relatively low cost.

Spotting the warning signs

So, what are the early warning signs? That again depends on the business and industry. But there are a few common themes such as:

- A mismatch between profit and cash

- Spending more time at or near your overdraft limit

- Declining sales through loss of market share or industry-wide disruption

- An absence of timely information for decision-making

- Regular surprises in your financials

- Erratic margins

- Slow paying customers

- Slow moving stock

- Non-financial factors, such as increased complaints, factory inefficiencies, increased health and safety incidents, or staff retention issues.

Acting

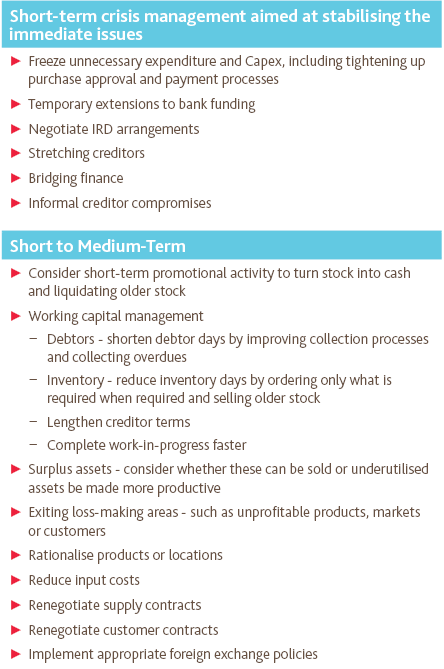

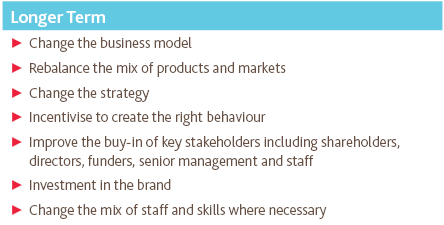

When the signs are identified, what do you do? Again, it depends at what stage of decline you are at. If you are high up the decline curve, you want to be acting on short through to long-term strategic issues. The further down the curve you are, the more short-term actions are required to manage the crisis.

Some examples of actions that can be considered are set out below. The first two categories, whilst very important to manage a crisis or improve efficiencies often do not address the underlying cause of the decline. They are important because they help steady the ship and buy more time to address the causes, but are not a complete solution. The third category (medium to long-term) actions should achieve that, though of course, these are sometimes the harder issues to address.

Where change is required, ensure that you understand the impact of making the change before jumping in boots and all. Usually it will require a gradual change so you don't bet the ranch on a sudden change. For example, it may have working capital implications or take time for staff or customers to accept the new direction. Also, you might be wrong - sometimes no amount of analysis or gut feel will guarantee you are making the right changes.

By way of an example, let’s take the wine sector – although the principles apply equally to other industries. The wine sector has grown strongly in recent years with earnings doubling over the past decade, annual growth averaging over 8% and total exports now around $2 billion per annum. Some participants are doing very well yet some are struggling under too much debt due to either recently acquiring land at record prices or producing more grapes or wine than they can sell.

Take a business that decides it wants to move from a lower margin grape growing business to a high margin branded packaged business. Those businesses have very different working capital needs and skill requirements. The transition is likely to take a number of years. Jumping in boots and all and stopping grape sales to convert all into wine without ensuring a channel to market would be devastating. Cash flow for grape sales following harvest is exchanged for winemaking and holding costs until it can be sold. Then the pressure is on to sell it before the next vintage is harvested. The better move would be to make the transition gradually to prove the business case and manage working capital impacts along the way. If things don’t pan out as planned, options are available.

So, when you identify the early warning signs, or perhaps you don't pick them up early and you face a crisis, don't waste it. Take the short-term actions required to manage the crisis and buy time, but do not stop there. Remember, you have not addressed the cause. Ask the hard questions, produce the analysis, involve key staff and other stakeholders. The good thing about a crisis is that it provides the opportunity to effect change quickly - just make sure you don't miss the opportunity a crisis provides.

Other articles in this edition of Business Edge: